Trump’s tariffs trigger : Despite a flicker of hope in factory output, Asia’s manufacturing sector is still wobbling on shaky ground—and all eyes are on Washington.

In June, several Asian economies reported contracting factory activity, weighed down by the looming threat of fresh U.S. tariffs and a broader global slowdown. Even in places where numbers inched up, the vibe on the ground? Still uncertain.

Some Hope, Mostly Headwinds

Let’s start with the few bright spots:

- Japan saw manufacturing expand for the first time in 13 months. But don’t get too excited—the rise was modest and new orders actually fell, thanks to fears over U.S. tariff hikes.

- China’s Caixin PMI surprised analysts by rising to 50.4, indicating slight expansion. But mixed signals from official data and low domestic demand keep the outlook “severe and complex,” according to Caixin’s own economist.

- South Korea’s contraction eased, with a PMI of 48.7, largely due to political clarity after the June 3 snap election.

But here’s the bigger picture:

“Volatility in U.S. tariff policy and economic recovery uncertainty are expected to persist in the second half of the year.” — South Korean Trade Minister Ahn Duk-geun

A Regional Slide

Elsewhere across Asia, the data painted a more worrying picture:

- Indonesia: PMI fell to 46.9

- Vietnam: Slipped to 48.9

- Taiwan: Dropped to 47.2

- Malaysia: Slight recovery, but still below the growth mark at 49.3

Across the board, demand is sluggish, and manufacturers are hesitant to invest or ramp up production.

The Tariff Ticking Time Bomb

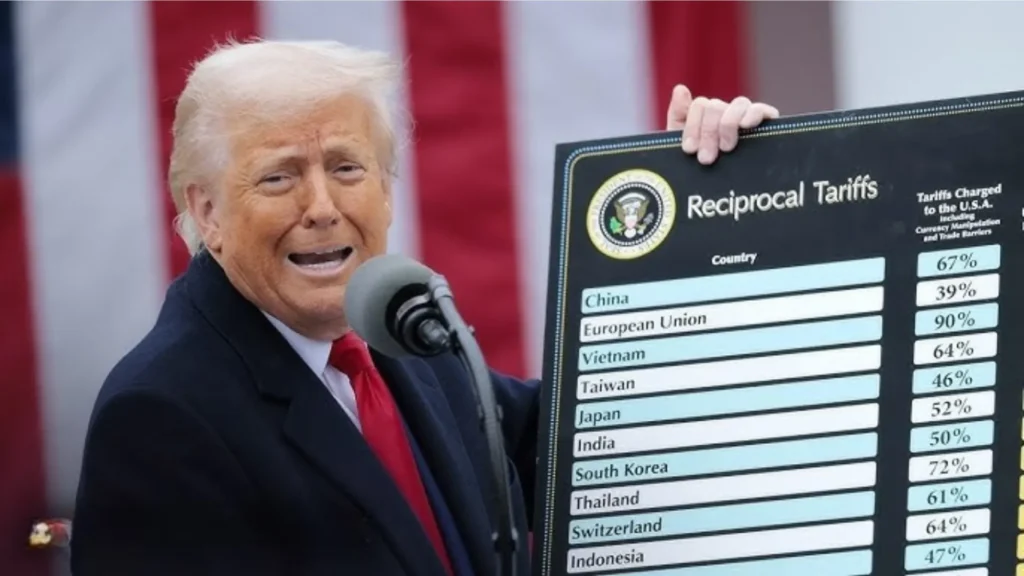

At the heart of the issue: U.S. President Donald Trump’s aggressive tariff policy (Trump’s tariffs trigger). With a July 9 deadline looming for new trade deals, more than a dozen major U.S. trade partners—including Japan, South Korea, and China—are scrambling to negotiate terms before import tariffs spike again.

- Automobile exports from Japan and South Korea are particularly at risk.

- Exports from South Korea to both China and the U.S. remain weak, even as total exports bounce back slightly.

Why It Matters

For Asian economies built on exports, this kind of volatility is like flying blind in a thunderstorm. Even a small signal of tariff relief—like Japan’s marginal uptick in PMI—isn’t enough to mask the larger storm of global trade uncertainty.As trade negotiators work overtime before the deadline, manufacturers across Asia are holding their breath—and so is the global economy.