Asia Stocks remained resilient on Monday, with stocks and the yen showing limited reaction to Japan’s weekend election results, as investors shifted their focus to corporate earnings and global trade developments.

Despite Japan’s ruling coalition losing control of the upper house in Sunday’s elections—further weakening Prime Minister Shigeru Ishiba’s political standing—the market response was muted. The Japanese yen gained 0.4% to trade at 148.29 against the dollar, as the outcome was widely anticipated.

“The loss was within expectations, and some had feared a worse outcome,” said Tsuyoshi Ueno, Chief Economist at Nissay Research Institute.

“Still, political uncertainty complicates U.S. negotiations and could limit the Bank of Japan’s ability to raise interest rates.”

Global Trade Hopes Build Amid Political Jitters

U.S. Commerce Secretary Howard Lutnick expressed optimism that a trade deal could still be reached with the European Union before President Donald Trump’s August 1 tariff deadline. Meanwhile, reports suggested that Trump and Chinese President Xi Jinping were inching toward a meeting—though likely not before October.

European Commission President Ursula von der Leyen is scheduled to meet with Xi later this week, potentially accelerating dialogue.

Markets Await Earnings From Big Tech

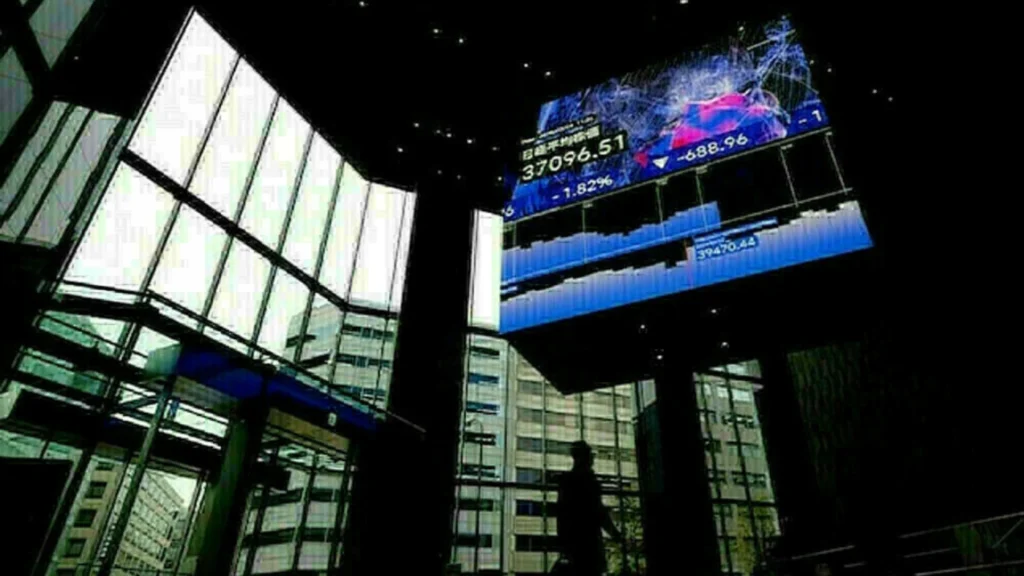

With Japan’s Nikkei index closed for a holiday, futures rose to 39,885, up from Friday’s cash close of 39,819. Broader regional activity was mixed:

- MSCI’s Asia-Pacific index (ex-Japan) edged down 0.1%

- South Korea’s KOSPI added 0.5%

- China’s CSI 300 Index gained 0.3%, led by rare earth and construction stocks after Beijing held interest rates steady

In Europe, EuroStoxx 50 and DAX futures dipped 0.3%, while FTSE futures were flat. In the U.S., S&P 500 and Nasdaq futures ticked up 0.2%, with both hovering near record highs as investors await key earnings reports.

Tech heavyweights Alphabet, Tesla, and IBM are set to report this week, as are defense firms RTX, Lockheed Martin (Asia Stocks), and General Dynamics—the latter buoyed by strong global military spending that has lifted the S&P 500 aerospace and defense index by 30% this year.

Microsoft Flags Cybersecurity Risks

In a related development, Microsoft issued a cybersecurity warning over active attacks on server software used by government agencies and businesses. The tech firm urged immediate updates to patch vulnerabilities.

Fed Rate Uncertainty Weighs on Bonds, Dollar

Bond markets remained steady, though investors are still parsing signals from the U.S. Federal Reserve. Governor Christopher Waller has reiterated his support for a rate cut in July, but most Fed officials, including Chair Jerome Powell, prefer to wait and assess inflation trends.

Markets see a 61% chance of a rate cut in September (Asia Stocks), rising to 80% by October. Powell has come under political pressure from Trump, who previously threatened to fire him over rate policy.

The euro held firm at $1.1630, having declined 0.5% last week. The U.S. dollar index dipped slightly to 98.373.

The European Central Bank (ECB) is expected to hold rates steady at 2.0% during its meeting this week, with analysts predicting continued cautious rhetoric tied to trade tensions.

Commodities Mixed as Supply Concerns Weigh on Oil

In commodities, gold rose 0.5% to $3,367 per ounce, while platinum rallied last week to its highest level since August 2014. Oil prices were caught between conflicting pressures—possible increased output from OPEC+ and concerns that EU sanctions on Russia could tighten supply.

- Brent crude inched up 0.1% to $69.38 per barrel

U.S. West Texas Intermediate (WTI) gained 0.2% to $67.50 per barrel

Get abhibus coupons for travel & From Dream Job to Layoff: How AI is Rewriting Tech Careers .