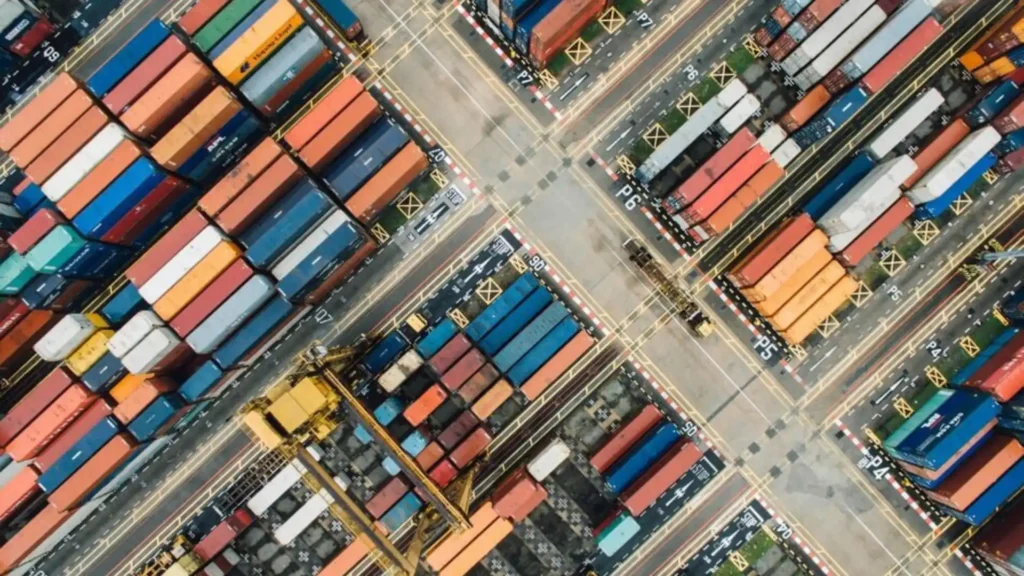

U.S. trade policy shifts are hitting global air cargo hard. After Washington ended the de minimis tax exemption for low-value imports from China and Hong Kong (Hits China-to-U.S) in early May, air cargo volumes from Asia to the U.S. plummeted.

Key Takeaways:

- Air cargo demand from Asia to North America dropped 10.7% YoY in May, according to IATA.

- E-commerce shipments (under $800) from China to the U.S. fell 43% in May alone.

- Previously tax-free, these shipments now face duties as high as 145%, though revised to ~30% mid-May.

- Airlines are rerouting freighters; direct China-U.S. cargo capacity fell 11% since March.

- Platforms like Shein and Temu are shifting focus to Europe, Southeast Asia, and Latin America.

- Low-value goods made up 55% of air cargo from China to the U.S. in 2023 — up from just 5% in 2018.

What’s Driving the Change?

- The U.S. is tightening de minimis loopholes, citing unfair tariff avoidance and national security concerns (e.g., drug smuggling).

- Tariff uncertainty ahead of a July 9 U.S. trade deadline is pushing companies to diversify export markets.

- Freight forwarders like Dimerco report up to 50% drops in e-commerce bookings for May–June.

Big Picture:The crackdown on the de minimis loophole marks a seismic shift in cross-border e-commerce logistics, with ripple effects for global air freight routes, shipping strategies, and tariff-sensitive supply chains. Companies are rebalancing their trade focus, and the U.S.-China trade relationship (Hits China-to-U.S) is once again center stage.

Read More : In Memoriam: Diogo Jota (1996–2025) & Use Firstcry Coupon Code today! Get upto 60% off on baby care essentials. Limited time!