In June, U.S. consumer prices saw their largest monthly increase in five months, according to data released by the Labor Department. While the rise signals the early effects of newly imposed tariffs on goods, underlying inflation indicators suggest overall price pressures remain contained. This mixed picture leaves the Federal Reserve in a holding pattern as it awaits clearer signs of economic direction.

What Happened

- The Consumer Price Index (CPI) rose by 0.3% in June, up from a 0.1% increase in May—marking the highest monthly gain since January.

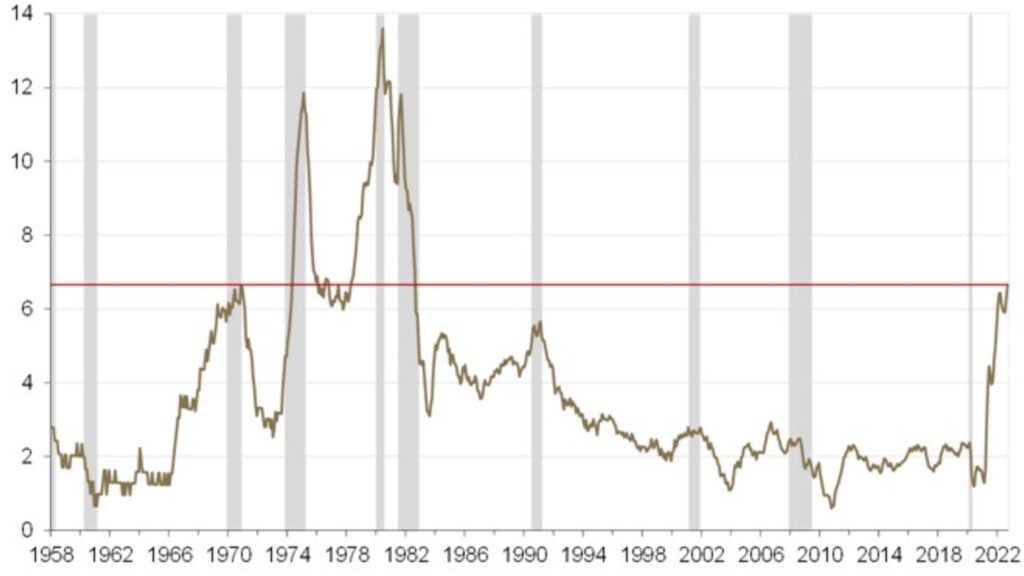

- On a 12-month basis, overall CPI increased by 2.7%, compared to 2.4% in May.

- The core CPI (excluding food and energy) climbed 0.2% in June and 2.9% year-over-year.

Why It Happened

- Tariffs imposed by the U.S. government began affecting prices, particularly for consumer goods.

- Businesses had previously been selling off inventory purchased before the tariffs, delaying price impacts until now.

- Gasoline prices rebounded (+1.0%) after four months of decline.

- Food costs continued rising, including:

- Nonalcoholic beverages (+1.4%)

- Coffee (+2.2%)

- Beef (+2.0%)

- Fruits and vegetables (+0.9%)

- Nonalcoholic beverages (+1.4%)

- Egg prices dropped sharply (-7.4%) as the impact of an avian flu outbreak subsided.

Why It Mattered

- Despite the jump in headline inflation, core inflation remained moderate, indicating that broader inflationary pressures are still under control.

- Prices declined in several key service areas:

- Airline fares

- Hotel and motel rooms

- Used and new vehicles

- Airline fares

- Consumer demand appears to be weakening, helping limit price increases in certain sectors.

Market & Policy Implications

- The Federal Reserve is expected to keep interest rates unchanged in its upcoming meeting, maintaining the 4.25%–4.50% range.

- Minutes from the Fed’s June meeting showed limited support for a rate cut in July.

- Economists and market analysts now look to the July and August CPI reports as critical indicators for potential policy changes later this year.

Sector-Specific Price Changes

Price Increases:

- Household furnishings and supplies: +1.0%

- Appliances: +1.9%

- Apparel: +0.4%

- Sporting goods: +1.4%

- Toys: +1.8%

Price Decreases:

- Used cars and trucks: -0.7%

- New vehicles: -0.3%

- Hotel and motel rooms: -3.6%

- Airline fares: -0.1%

Outlook

- Goldman Sachs expects monthly core inflation to rise 0.3%–0.4% through the summer, largely driven by tariff-related increases in consumer electronics, autos, and apparel.

The impact on core services inflation is expected to be limited in the near term.